Thinking buying cabinets from China is just about price and shipping? Many get burned by hidden costs, customs nightmares, and quality issues that turn dream projects into costly disasters.

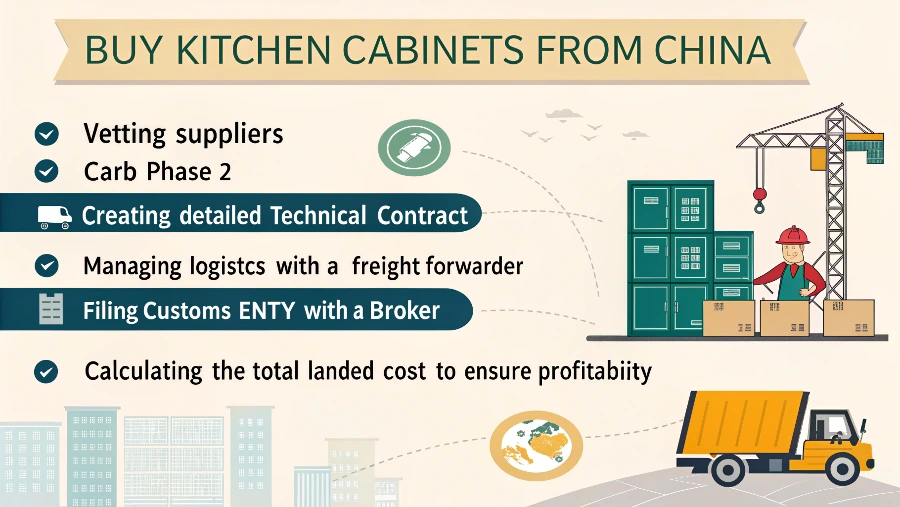

To buy kitchen cabinets from China, you must vet suppliers for compliance with US standards like CARB Phase 2, create a detailed technical contract, manage logistics with a freight forwarder, file customs entry with a broker, and calculate the total landed cost to ensure profitability.

I’ve seen too many buyers focus only on the FOB price. They think they’ve found a great deal, but then the problems begin. Their cabinets get held by customs for missing formaldehyde certifications, or they arrive with measurements that are off by half an inch, making them useless on a US job site. The secret isn’t finding the cheapest supplier; it’s about controlling the entire process. You need to manage the details—from compliance paperwork to packaging—to protect your investment. Let me show you how.

How much does it cost to ship kitchen cabinets from China to USA?

Hoping for a simple shipping quote? The final bill is often shockingly higher. Seasonal demand and hidden port fees can completely change the cost of shipping cabinets from China to the US.

Shipping a 40-foot container of kitchen cabinets from China to the USA typically costs between $3,000 and $10,000. The final price depends heavily on the shipping route, time of year, and carrier. Less-than-container (LCL) options are available but cost more per cubic meter.

The price a freight company first gives you is just the start. The real cost includes many other fees that show up later. I always tell my clients to budget for the entire journey, from the factory door in China to their warehouse in the US. Kitchen cabinets are bulky and heavy, so understanding your shipping options is critical.

FCL vs. LCL for Kitchen Cabinets

- Full Container Load (FCL)1: This is almost always the best choice for cabinets. You rent a full 20 or 40-foot container. This protects your cabinets from being handled alongside other people’s cargo, reducing the risk of damage. It is also the most cost-effective method if you are ordering a full kitchen or multiple sets.

- Less-than-Container-Load (LCL)2: You share container space. While it seems cheaper for a very small order, I strongly advise against it for cabinets. The risk of scratches, dents, and broken parts is much higher because your goods are loaded and unloaded multiple times. The potential cost of replacing damaged pieces will quickly erase any freight savings.

Key Factors in Your Final Shipping Bill

| Factor | Description | Why It Matters for Cabinets |

|---|---|---|

| Incoterms3 | The terms agreed upon with your supplier (e.g., FOB, EXW). | Determines if you pay for trucking from the factory to the port in China. |

| Port Fees (THC) | Terminal Handling Charges at both the origin and destination ports. | These are unavoidable fees that are often not in the initial quote. |

| Inland Trucking | Transporting the container from the US port to your final destination. | Can be very expensive, especially if your job site is far from the port. |

Always get a "door-to-door" quote from your freight forwarder to see the full picture.

How can I import kitchen cabinets from China?

Think you can just find a supplier online and place an order? Without a strict process, you risk getting cabinets that don’t meet US standards or don’t fit your project’s dimensions.

To import kitchen cabinets, you need a multi-step process: Vet suppliers for quality and compliance. Finalize every design detail. Sign a clear contract. Hire a freight forwarder and customs broker. And finally, arrange for a third-party inspection before shipment.

Kitchen cabinets are not a simple commodity. They are highly customized products. A few years ago, a client tried to save time by skipping the detailed measurement verification. The cabinets arrived, and the drawer holes were drilled for metric hardware, not the US-standard hardware he planned to use. The cost to fix that on-site, one hole at a time, was a nightmare. This is why having a rigid, step-by-step process is non-negotiable.

Step 1: Find a Compliant and Capable Supplier

Don’t just look for the lowest price. Ask for proof of compliance with US regulations like TSCA Title VI4 and CARB Phase 25 for formaldehyde emissions. Request references from other US buyers. A good supplier should be able to provide test reports and understand the quality expectations of the US market.

Step 2: Create a Detailed Technical Order

Your purchase order must be more than just a list of items. It needs to be a detailed technical document.

- Include shop drawings with precise dimensions in inches.

- Specify all materials (e.g., solid birch frame, plywood box).

- Define the finish, color codes, and hardware specifications.

- Outline the packaging requirements (e.g., corner protectors, individual boxing).

Step 3: Hire Professionals and Inspect Before Shipping

You need two key partners: a freight forwarder and a customs broker. They will navigate the logistics and legal requirements. Most importantly, I always insist on a third-party pre-shipment inspection6. An inspector will go to the factory to verify the quality, quantity, and packaging against your order before you make the final payment. This simple step can save you thousands of dollars and weeks of delays.

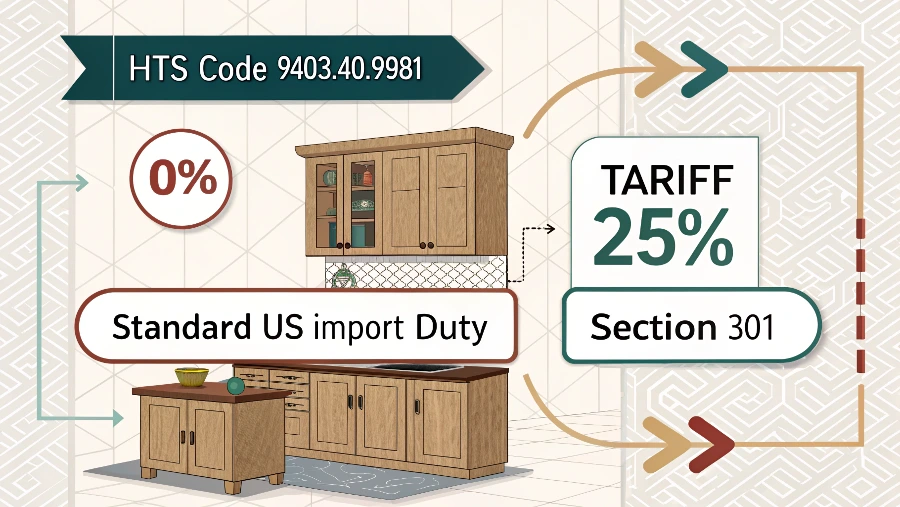

What is the import duty on kitchen cabinets from China?

Worried about import taxes eating into your budget? The standard duty is often zero, but other tariffs on Chinese goods are the real cost you need to watch out for.

The standard US import duty for wooden kitchen cabinets (HTS Code 9403.40.9081) is 0%. However, these products are subject to an additional Section 301 tariff, which can be up to 25%, drastically increasing the total cost.

This is one of the biggest "hidden costs" that surprises new importers. They look up the standard duty and think they are in the clear, but they forget about the Section 301 tariffs. These tariffs were put in place during the US-China trade dispute and cover a huge range of products, including most cabinets and furniture.

Decoding Your Duty and Tariff Costs

The cost you pay customs is based on the value you declare on the Commercial Invoice. Here’s how it works:

- Find the HTS Code: Your customs broker will classify your specific cabinets with a Harmonized Tariff Schedule (HTS) code7. For wooden kitchen cabinets, it’s typically in the 9403.40 category.

- Check Standard Duty8: The broker confirms the regular duty rate for that code, which is usually 0% for cabinets.

- Check Section 301 Tariffs9: This is the critical step. Your broker must check if your HTS code is on the current Section 301 list. If it is, this additional percentage (e.g., 25%) is applied to your product’s value.

For example, on a $20,000 cabinet order:

- Standard Duty2 (0%): $0

- Section 301 Tariff (25%): $5,000

This $5,000 is a direct cost to you. These tariff rates can change based on government policy, so you must verify the current rate before you place your order.

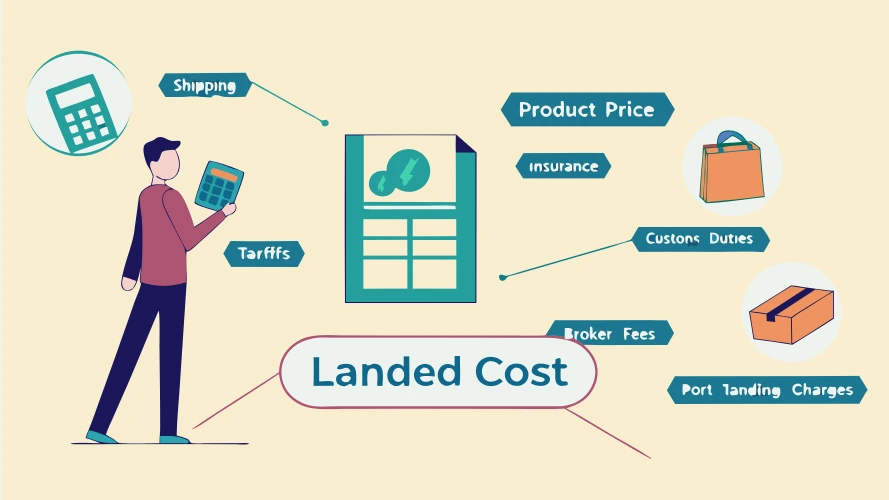

How do you calculate the true cost of importing kitchen cabinets?

Is the price from the Chinese factory your final cost? Not even close. Many first-time importers are shocked when the final bill is 30-50% higher than they expected.

To find the true cost, you must calculate the "landed cost." This includes the product price plus all shipping, insurance, customs duties, tariffs, broker fees, port handling fees, and inland trucking charges to your final destination.

I always tell my clients that if they can’t calculate their landed cost, they can’t protect their profit. The FOB price your supplier gives you only covers the cost of the goods and getting them to the port in China. It does not include the long list of expenses to get those cabinets across the ocean and to your door. All those "in-between" fees are where your budget can fall apart.

A Sample Landed Cost Calculation

Let’s break down the costs for a hypothetical container of kitchen cabinets with a factory cost of $25,000.

| Cost Component | Description | Example Cost |

|---|---|---|

| 1. FOB Product Cost | Price for the cabinets from your supplier. | $25,000 |

| 2. Ocean Freight & Insurance10 | Cost to ship a 40′ container and insure it. | $5,000 |

| 3. US Customs Duties | Standard duty (0% for cabinets). | $0 |

| 4. Section 301 Tariffs11 | Additional tariff (e.g., 25% on the product cost). | $6,250 |

| 5. Port & Broker Fees | Customs clearance, harbor fees, document fees. | $950 |

| 6. Inland Trucking | Transporting the container from the port to your warehouse. | $1,500 |

| Total Landed Cost12 | The true total cost to get the cabinets. | $38,700 |

In this example, the true cost is over 50% higher than the product cost. This is why you must do this math before you sign any purchase order. It’s the only way to know if importing is actually the right financial decision for your project.

Who is the largest manufacturer of kitchen cabinets in the US?

Thinking about why you should import at all? Knowing the top domestic players helps you understand the market you are competing in and why getting your import process right is so important.

The largest manufacturer of kitchen cabinets in the United States is MasterBrand Cabinets. The company owns a large portfolio of brands, including Aristokraft, Decora, Diamond, and Omega, catering to a wide range of price points and styles.

So, why would a buyer like you choose to import from China when you have a giant like MasterBrand operating right here in the US? The two biggest reasons are typically cost savings and the ability to get fully custom designs that might be harder or more expensive to source domestically. However, this is a critical point: to actually realize those cost savings, your import operation has to be flawless.

Competing with Domestic Giants

When you buy from a domestic manufacturer like MasterBrand, you get a streamlined process. Their supply chains are established, their products already meet all US standards, and delivery is relatively simple. When you import, you are taking on all of that complexity yourself.

Your job is to build a supply chain that is just as reliable. This is why all the details we’ve discussed are so vital:

- Compliance13: You must ensure your products meet the same safety and environmental standards (CARB, TSCA).

- Quality Control14: You must implement your own checks (like third-party inspections) to match their factory quality.

- Logistics15: You must manage a global shipping process to compete with their local delivery times.

If you can master these details, you can successfully leverage the cost advantages of global sourcing. If you don’t, the hidden costs and delays will quickly make the domestic option look much more attractive.

Conclusion

Buying kitchen cabinets from China succeeds on details, not just price. Master compliance, calculate your full landed cost, and control every step to avoid common pitfalls and ensure a profitable project.

-

Exploring this resource will provide insights into why FCL is the preferred choice for shipping kitchen cabinets, ensuring safety and cost-effectiveness. ↩

-

Understanding the risks of LCL shipping can help you make informed decisions and avoid costly damages to your cabinets during transport. ↩ ↩

-

Learning about Incoterms will clarify how shipping terms impact your overall costs and responsibilities when importing kitchen cabinets. ↩

-

Understanding TSCA Title VI is crucial for ensuring your supplier meets US regulations on formaldehyde emissions, protecting your business and customers. ↩

-

Exploring CARB Phase 2 requirements helps ensure your suppliers comply with California’s strict air quality standards, enhancing product safety. ↩

-

Learning about third-party pre-shipment inspections can help you avoid costly mistakes and ensure product quality before payment. ↩

-

Understanding HTS codes is crucial for accurate customs declarations and avoiding unexpected costs. Explore this link for detailed insights. ↩

-

Knowing how Standard Duty is calculated can help you budget for imports effectively. Check this link for comprehensive information. ↩

-

Section 301 Tariffs can significantly impact your import expenses. Learn more about their implications and updates by visiting this resource. ↩

-

Learn about Ocean Freight & Insurance to better estimate shipping expenses and avoid unexpected costs. This knowledge is vital for importers. ↩

-

Section 301 Tariffs can significantly impact your import costs. Discover how they work and their implications for your business. ↩

-

Understanding Total Landed Cost is crucial for accurate budgeting in imports. Explore this link to gain insights into its components and importance. ↩

-

Understanding compliance standards is crucial for ensuring your products meet safety and environmental regulations, which can save you from costly penalties. ↩

-

Effective quality control is essential for maintaining product standards and customer satisfaction, making it a key area to explore for successful sourcing. ↩

-

Mastering logistics can significantly enhance your supply chain efficiency, helping you compete effectively with domestic manufacturers. ↩