How to Import Furniture from China to USA – Costs, Duties, and Tips?

Struggling with the complexities of importing furniture? Hidden costs, damaged goods, and customs delays can turn a profitable venture into a nightmare. Here is my proven, step-by-step process.

To import furniture from China to the USA, you must find a reliable supplier, ensure product compliance with US standards like CARB and TSCA, manage shipping logistics, file the correct customs documentation with a customs broker, and pay all applicable duties and fees to ensure a smooth delivery.

Importing furniture from China is about more than just finding a low price. I’ve seen many buyers get excited about a cheap quote, only to face massive headaches later. They forget to check for critical safety certifications or to specify durable packaging. The real key to success is controlling the entire process, from the factory floor in China to the final delivery address in the USA. It’s about building a secure and predictable supply chain. Let’s break down exactly what you need to know to do this right and avoid the common pitfalls.

How much does it cost to ship furniture from China to USA?

Hoping for a simple shipping quote? The final price is often full of surprises, with factors like season and container size drastically changing your total cost from China to the USA.

Shipping a full 40-foot container (FCL) from China to the USA can range from $3,000 to $10,000 or more, depending on the season, ports, and carrier. Less-than-container-load (LCL) shipments are priced per cubic meter, typically between $100 and $300, but have higher per-unit costs.

The price you see on a freight quote is never the final price. I always tell my clients to budget for the entire journey, not just the ocean part. The true cost involves multiple stages, and understanding them is key to protecting your profit margin. Let’s look at the main components that determine your final shipping bill.

Full Container Load (FCL)1 vs. Less-than-Container-Load (LCL)2

Your first big decision is how you’ll ship your goods.

- FCL: You rent an entire 20-foot or 40-foot container. This is the most cost-effective option if you have enough furniture to fill it. You get a flat rate for the container, and it’s generally faster and safer since your goods are not handled with others.

- LCL: You share container space with other importers. You pay based on the volume (in cubic meters) your furniture occupies. While it seems cheaper for small orders, the per-unit cost is higher, and there’s a greater risk of damage because your items are loaded and unloaded more frequently.

Key Factors Influencing Freight Costs

Several variables can make your shipping costs go up or down.

| Factor | Description | Impact on Cost |

|---|---|---|

| Seasonality | Shipping rates spike during peak seasons (August–October) before major holidays. | High |

| Port Congestion | Delays at major ports like Los Angeles or Long Beach can add fees. | Medium |

| Fuel Prices | Fluctuations in global oil prices directly affect carrier surcharges. | Medium |

| Incoterms | The agreed-upon shipping term (e.g., FOB, EXW) determines who pays for what part of the journey. | High |

I always advise clients to book their shipments well outside of peak season if possible. A few weeks can make a difference of thousands of dollars on an FCL shipment.

How can I import furniture from China?

Thinking about placing an order in China? A simple click and buy isn’t enough. Without a solid plan, your furniture could get stuck, and your project could face serious delays.

To import furniture, first find and vet a reliable supplier. Then, confirm all product specifications and compliance needs. Next, hire a freight forwarder and customs broker, prepare all necessary documents like the Bill of Lading and Commercial Invoice, and arrange final delivery after clearing customs.

Over my years in this business, I’ve developed a checklist that I follow for every single import project. It’s not just about managing logistics; it’s about reducing risk at every step. A client once skipped the factory-vetting step to save time, and the furniture they received was the wrong color and material. That mistake cost them more than just money; it damaged their reputation. Here are the essential steps I never skip.

Step 1: Find and Vet Your Supplier

Don’t just rely on online directories. You need to verify that the supplier is a legitimate business with a good track record. Ask for their business license3, quality certifications (like ISO 90014), and references from other buyers in your country. If possible, I recommend ordering a sample first to check the quality firsthand. This is also the time to test their communication and responsiveness.

Step 2: Negotiate Terms and Sign a Detailed Contract

Your purchase agreement should be extremely detailed. It must include:

- Product specifications (materials, dimensions, colors)

- Packaging requirements (very important for furniture!)

- Pricing and payment terms

- The Incoterm (e.g., FOB Shanghai)

- Production lead time and delivery deadlines

- Penalties for delays or quality issues

Step 3: Arrange Logistics and Customs Clearance

You don’t have to manage this alone. A good freight forwarder5 will handle the shipping from the Chinese port to the US port. A licensed customs broker will handle the paperwork to get your goods cleared by US Customs and Border Protection (CBP). They are essential partners in this process.

What is the import duty on furniture from China?

Worried about high import taxes? Many importers are surprised by tariffs, especially the extra duties on Chinese goods. These fees can heavily impact your final costs if you don’t plan for them.

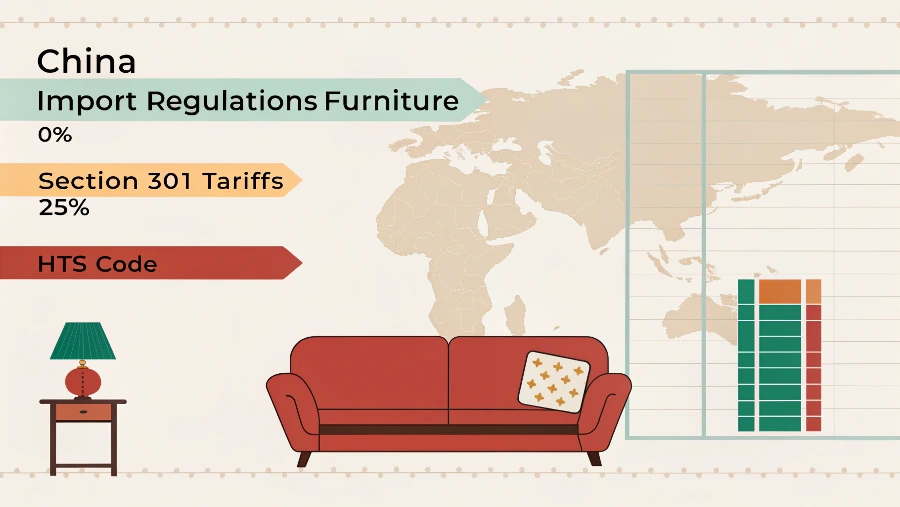

Most furniture imported from China has a standard import duty of 0%. However, many items are subject to additional Section 301 tariffs, which can be as high as 25%. The exact rate depends on the specific HTS code for your product.

Calculating duties isn’t as simple as it sounds. The Harmonized Tariff Schedule (HTS) code is everything. A client once misclassified a set of office chairs and ended up paying a much higher duty rate than necessary. Getting the code right is a critical step that your customs broker will help with, but you should have a basic understanding of how it works.

Understanding HTS Codes

The HTS code6 is a unique number that classifies your product for customs. Every type of furniture has a different code. For example:

- Wooden office furniture falls under HTS code1 9403.30.8000.

- Metal office furniture falls under HTS code1 9403.10.0040.

- Upholstered wooden chairs fall under HTS code1 9401.61.4011.

The standard duty for most of these furniture categories is zero. The real cost comes from other taxes.

Section 301 Tariffs7

These are additional tariffs the US government placed on a wide range of goods from China. Many furniture products are on this list. These tariffs are subject to change, so you must verify the current rate for your specific HTS code1 before you place an order. Your customs broker8 can confirm the latest tariff information for you. These tariffs are calculated on the cost of the goods, so they can add a significant amount to your total import cost. It’s a political issue that directly affects our business.

Can you import furniture into the US?

Is it even possible to bring in furniture yourself? Yes, it is, but it’s not like ordering a package from Amazon. The US government has strict rules, especially for wood and textiles.

Yes, you can import furniture into the US for both commercial and personal use. However, you must comply with all regulations from agencies like Customs and Border Protection (CBP), the Environmental Protection Agency (EPA), and the Consumer Product Safety Commission (CPSC) to ensure safety and legality.

The short answer is yes, but the long answer involves a lot of compliance work. I’ve seen shipments stopped for weeks simply because one required document was missing. The US customs process is designed to protect consumers and the environment, so they take these regulations very seriously. If you want a smooth import process, you have to treat compliance as a top priority from day one.

Key Compliance Requirements

Before your furniture can even leave China, you need to ensure it meets US standards. The most common ones for furniture are:

- TSCA Title VI9: This EPA rule sets formaldehyde emission standards for composite wood products like particleboard, MDF, and hardwood plywood. Your supplier must provide a certificate showing their products are compliant. Without it, your goods will be denied entry.

- CARB Phase 210: This is a similar California standard for formaldehyde emissions that has been adopted nationwide. Ensure your supplier’s products are certified.

- Lacey Act: This act requires importers of certain plants and plant products, including some wood furniture, to file a declaration. It helps combat illegal logging.

CPSC Flammability Standards11

If you are importing upholstered furniture (sofas, armchairs), it must meet flammability standards set by the CPSC to reduce fire hazards. Your supplier should be able to provide test reports proving compliance. I always ask for these reports during the sample stage. Making sure your products are safe and legal is not just about following rules; it’s about protecting your business and your customers.

How do you calculate the true cost of importing furniture?

Is the factory price the final price? Far from it. New importers often overlook dozens of small fees that add up quickly, eating away at their expected profits when importing from China.

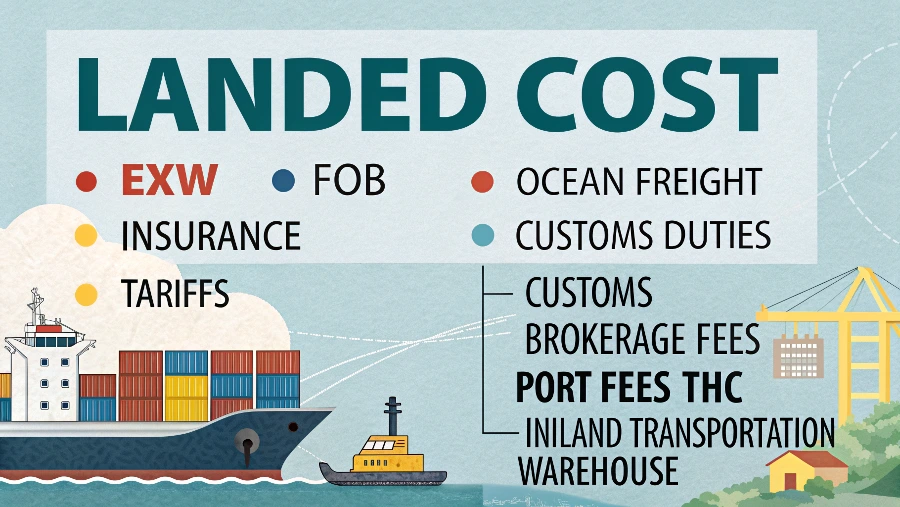

To calculate the true cost, you must add the factory price (EXW or FOB) to all other expenses: ocean freight, insurance, customs duties, tariffs, customs brokerage fees, port fees (THC), and inland transportation to your warehouse. This is called the landed cost.

I have a simple rule: if you don’t know your landed cost, you don’t know your profit. A few years ago, a new buyer I was advising focused only on the FOB price from the supplier. He was shocked when the final bill was nearly 40% higher after all the other fees were added. He hadn’t budgeted for customs exams, port demurrage, or the cost of trucking the container from the port to his warehouse. Let’s create a clear checklist so that never happens to you.

Landed Cost12 Calculation Breakdown

Here is a table outlining the typical costs you need to sum up to find your true cost per unit.

| Cost Component | Description | Example (for a $20,000 order) |

|---|---|---|

| 1. Product Cost (FOB) | The price of the goods, including transport to the Chinese port. | $20,000 |

| 2. Ocean Freight13 | Cost to ship the container from China to a US port. | $4,500 |

| 3. Marine Insurance | Insurance to cover loss or damage during transit (~0.5% of value). | $125 |

| 4. US Customs Duties14 | Calculated on the product cost (e.g., 0% standard duty). | $0 |

| 5. Section 301 Tariffs | Additional tariff (e.g., 25% on the product cost). | $5,000 |

| 6. Brokerage & Port Fees | Fees for customs clearance, port handling (THC), etc. | $800 |

| 7. Inland Trucking | Cost to transport the container from the US port to your door. | $1,200 |

| Total Landed Cost1 | The sum of all the above costs. | $31,625 |

As you can see, the final cost is significantly higher than the initial product cost. Always use a landed cost formula to get a realistic picture before you commit to an order. This is the only way to ensure your project is profitable.

How much does an import license cost in the USA?

Do you need an expensive license to import? This is a common question, and many people think it’s a complex, costly hurdle. The reality is much simpler for most importers.

The USA does not require a federal "import license" for general goods like furniture. However, if your shipment is valued over $2,500, you will need a Customs Bond, which can cost between $250 to $500 annually for a continuous bond.

Let’s clear this up, because the terminology confuses a lot of first-time importers. You don’t apply for a general "permission to import" license. Instead, certain requirements act like a license. The most important one is the Customs Bond. It’s not optional for most commercial shipments; it’s a mandatory financial guarantee required by CBP.

What is a Customs Bond15?

A Customs Bond1 is essentially an insurance policy that guarantees CBP will get paid for all duties and taxes owed on your shipment. If you, the importer, fail to pay them, the surety company that issued the bond will pay on your behalf and then come to you for reimbursement. It’s a way for the government to secure its revenue.

Types of Customs Bond15s

There are two main types you should know about:

- Single Entry Bond16: This bond covers a single import shipment. It’s good if you only plan to import once or twice a year. The cost is calculated based on the value of your shipment.

- Continuous Bond17: This bond covers all your shipments for a full year. If you plan to import multiple times, this is by far the most cost-effective option. A continuous bond typically costs a flat fee of around $250 to $500 and is the standard choice for any serious commercial importer.

I always recommend a continuous bond to my clients. It simplifies the process for future shipments and saves a lot of money and paperwork in the long run. Your customs broker can easily help you purchase one.

Conclusion

Importing furniture from China is a manageable process if you focus on compliance, detailed contracts, and calculating your true landed cost. Following these steps ensures a smoother, more predictable outcome.

-

Exploring this resource will provide you with insights on the advantages of FCL shipping, helping you make informed decisions for your logistics. ↩ ↩ ↩ ↩ ↩ ↩ ↩

-

Understanding the drawbacks of LCL shipping can help you avoid potential pitfalls and choose the best shipping method for your needs. ↩

-

Understanding the significance of a business license can help you ensure your supplier is legitimate and trustworthy. ↩

-

Exploring ISO 9001 certification can provide insights into quality management standards that ensure supplier reliability. ↩

-

Learning about freight forwarders can simplify your logistics process and ensure efficient shipping of your goods. ↩

-

Understanding HTS codes is crucial for accurate customs classification and avoiding delays in shipping. Explore this resource to learn more. ↩

-

Section 301 Tariffs can significantly impact your import costs. This resource will help you understand their implications and current rates. ↩

-

A customs broker is essential for navigating tariffs and ensuring compliance. Learn how they can assist you in the import process. ↩

-

Understanding TSCA Title VI is crucial for ensuring your furniture meets US standards and avoids entry denial. ↩

-

Learn about CARB Phase 2 to ensure your imported furniture complies with national formaldehyde emission standards. ↩

-

Explore CPSC flammability standards to ensure your upholstered furniture is safe and compliant, protecting your business and customers. ↩

-

Understanding Landed Cost is crucial for accurate budgeting and ensuring profitability in international trade. ↩

-

Exploring Ocean Freight costs can help you optimize shipping expenses and improve your overall logistics strategy. ↩

-

Learning about US Customs Duties can prevent unexpected costs and ensure compliance with import regulations. ↩

-

Understanding Customs Bonds is crucial for importers to ensure compliance and avoid penalties. Explore this link for detailed insights. ↩ ↩

-

Learn about Single Entry Bonds to determine if it’s the right choice for your occasional imports. This resource can clarify your options. ↩

-

Discover why a Continuous Bond is often the best choice for frequent importers, saving time and money. This link provides valuable information. ↩