China’s office furniture market is evolving rapidly, establishing itself as the world’s largest exporter. Chinese manufacturers are expanding their global presence, attracting attention from international businesses.

This article explores the current market landscape, top manufacturers, growth potential, distribution patterns, and key trends to help businesses choose the right office furniture supplier in China.

Overview of China’s Office Furniture Market

China is the world’s leading producer and exporter of office furniture, known for its competitive pricing, high quality, and efficient exports. Before diving into how to import office furniture, let’s explore why China is the top choice.

Market Scope & Key Regions

The office furniture market in the Asia-Pacific region includes:

- Major producers: China, Japan, Malaysia

- Key markets: Australia, South Korea, Taiwan, Thailand, Vietnam

Office Furniture Categories

- Office seating (various types)

- Operative desks

- Executive furniture

- Office storage

- Wall-to-wall units

Market Size & Growth Trends

- Exports: In 2019, China’s office furniture exports reached $5.336 billion, with a $5.235 billion trade surplus (General Administration of Customs).

- Revenue: The industry was valued at $12.46 billion in 2020, with an expected annual growth rate of 7.6% (2020-2023) (Statista).

- COVID-19 Impact: In March 2020, exports dropped 6.6% due to the pandemic, and further pressure on exports is expected.

Major Developments

- Net City Project, Shenzhen: In 2018, NBBJ designed Tencent’s 21-million-square-foot tech hub in Shenzhen, roughly the size of Midtown Manhattan. This project highlights the increasing demand for office furniture as China’s commercial landscape expands (The Wall Street Journal).

China’s office furniture industry continues to grow, driven by strong global demand and urban development, despite economic challenges.

1.China’s Office Furniture Industry: Growth, Market Leaders, and Future Prospects

1.1 Growth of Office Furniture Manufacturers

The demand for office furniture in China has surged both domestically and internationally, leading to a steady increase in manufacturers. Over the past decade, the number of office furniture manufacturers in China has grown at a 7.91% year-over-year rate.

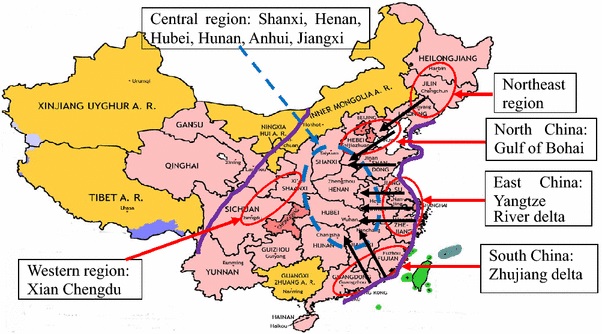

The key manufacturing hubs are located in:

- Yangtze River Delta – Shanghai, Jiangsu, Zhejiang

- Pearl River Delta – Guangdong, Foshan, Shenzhen

- Bohai Rim Region – Beijing, Tianjin, Shandong, Hebei

- Northeast China – Liaoning, Jilin, Heilongjiang

- Western China – Chongqing, Sichuan, Shaanxi

East China (Shanghai, Jiangsu, Zhejiang) is known for high-quality modern office furniture, while North China (Shandong, Hebei) specializes in traditional Chinese-style furniture.

1.2 Top 10 Office Furniture Manufacturers in China

The leading office furniture manufacturers in China include:

- Lamex

- Aurora

- BOKE

- SUNON

- QUAMA

- Kinwai

- LOGIC

- UB

- Onlead

- UE

Aurora originally came from Taiwan and entered the Chinese market in the early 1990s. Over 30 years, it has expanded into office equipment, furniture, 3D printing, electronics, and cloud business solutions.

📌 For more details, visit: Top 10 Chinese Office Furniture Manufacturers

1.3 The Market Potential for Intelligent Office Furniture

The smart office furniture market in China is experiencing rapid growth due to advancements in production technology and digital integration.

Key Factors Driving Smart Furniture Growth:

- Workspaces are becoming smarter, with a focus on ergonomics, productivity, and efficiency.

- China is in its “golden era” of high-end office building development, increasing demand for premium furniture.

- Millennials and Gen Z (post-90s workforce) are fueling demand for customized, tech-integrated office furniture.

Major manufacturers like Aurora and BOKE are actively expanding their smart furniture offerings to cater to the changing office landscape.

1.4 Future Growth of China’s Office Furniture Market

The Chinese office furniture market is projected to exceed ¥200 billion in the coming years.

Market Growth & Forecasts:

- Global Market: In 2017, the total global office furniture trade reached $30.4 billion, with an annual increase of 2.01%. By 2023, this figure is expected to reach $36.9 billion (Prospective Industry Research Institute).

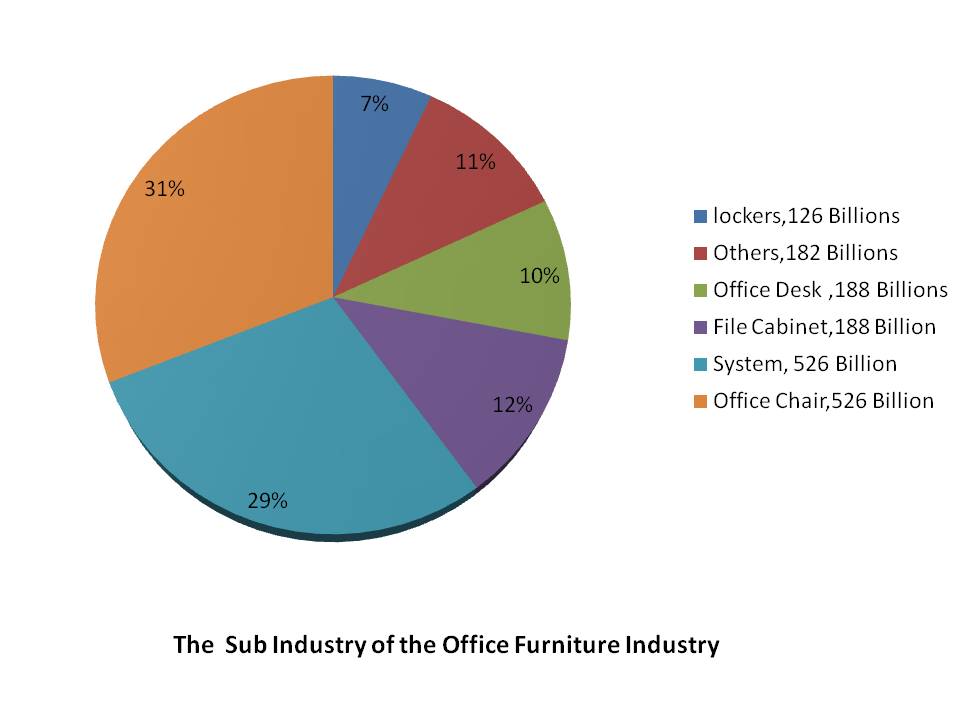

- China’s Market: In 2017, the Chinese office furniture market was valued at ¥181.1 billion, with:

- Office chairs: ¥56.4 billion (31% market share)

- Office systems (desks, cabinets, etc.): ¥52.6 billion (29% market share)

By 2024, the Chinese intelligent and customized office furniture market is expected to exceed ¥280 billion, making it a key driver of future industry growth.

1.5 The Largest Subsector in Office Furniture: Office Chairs

📌 For more details, visit Top 10 Office Chair Manufacturers in China.

Since the 1990s, the office furniture sector has expanded to include:

- Office chairs

- Desks & filing cabinets

- System furniture (screen systems, modular workstations)

- Home theater seating & lockers

Why Office Chairs Lead the Market?

Office chairs dominate the industry, accounting for 31% of the total office furniture market in China. Their popularity continues to grow in both domestic and international markets due to the increasing demand for ergonomic and adjustable seating solutions.

2. Distribution Patterns of Office Furniture in China

China’s office furniture industry is primarily concentrated in five key industrial zones:

- Pearl River Delta – The most developed and export-driven region, benefiting from its strategic location for shipping goods overseas, particularly to the Americas and other regions.

- Yangtze River Delta – Centered in Jiangsu, Zhejiang, and Shanghai, this region specializes in solid wood furniture and swivel chairs, contributing one-third of the total office furniture output in China.

- Bohai Rim – Located in North China, this area focuses on traditional and classical Chinese furniture, catering to both domestic and Southeast Asian markets.

- Northeast China – An emerging hub for furniture manufacturing, supporting domestic demand and exports.

- Western China – Developing as a growing production region with increasing market potential.

The Yangtze River Delta and Pearl River Delta industrial zones together account for two-thirds of China’s office furniture production.

Related article: Top 5 Supplier Locations in China – The Ultimate Guide

2.1 The Output Value of Yangtze River Delta and Pearl River Delta

Pearl River Delta (Foshan, Guangdong)

- Foshan is the birthplace of China’s modern office furniture industry, home to the largest and most mature furniture production cluster in the world.

- Shunde District in Foshan has over 6,000 furniture enterprises, forming a fully integrated industrial chain for office furniture manufacturing.

- Lecong Furniture City in Shunde:

- Spans 2.8 million square meters

- Hosts over 3,800 shops

- Exhibits more than 20,000 furniture products from China and worldwide

- Exports large volumes to East China, Europe, and the U.S.

- Generates annual sales exceeding ¥30 billion, ranking first in China.

- Longjiang Town, also in Shunde, specializes in:

- Swivel chairs and sofas, leading the Chinese office furniture market.

- Holds a national market share of about one-sixth in office furniture.

Related article: Top 8 Lecong Furniture Mall Shopping Guide

Yangtze River Delta (Shanghai, Jiangsu, Zhejiang)

- Specializes in swivel chairs, solid wood furniture, and office desks.

- Accounts for one-third of China’s total office furniture production.

- Main export markets: Europe and the United States.

2.2 Office Furniture Industry Distribution Overview

| Industrial Area | Key Cities | Provinces | Strengths | Export Markets | Key Characteristics |

|---|---|---|---|---|---|

| South China Furniture Industry Zone | Guangzhou, Shenzhen, Dongguan, Foshan (Shunde) | Guangdong | Strong industrial cluster, complete supply chain, brand advantages | America & global export markets | Shunde is the main production and wholesale center; Lecong is a major furniture distribution hub. |

| East China Furniture Industry Zone | Shanghai, Nanjing, Hangzhou | Jiangsu, Zhejiang, Shanghai | High product quality, strong production management | Europe & the U.S. | Focuses on swivel chairs, solid wood office furniture, and premium products. |

| North China Furniture Industry Zone | Beijing, Tianjin, Qingdao | Beijing, Tianjin, Hebei, Shandong | High market demand, enterprise-driven economy | China, Southeast Asia | Specializes in traditional and classical Chinese furniture. |

3. China Office Furniture Industry Development Trend Analysis

The Chinese office furniture industry is evolving rapidly, influenced by technological advancements, market differentiation, sustainability trends, and changing consumer preferences. Below is an analysis of the major trends shaping the industry.

3.1 Rise of Advanced Equipment and Production Technology

As demand for office furniture grows, the need for advanced production technology has also increased. In the past, German company Homag dominated the market for customized furniture machinery. However, in the last five years, domestic companies such as Hongya CNC and Nanxing Equipment have emerged as strong competitors. More furniture manufacturers are now purchasing high-quality domestic equipment, leading to continuous improvements in production technology.

3.2 Market Conditions: Dominance of Large Enterprises

The office furniture industry in China is primarily driven by large enterprises that provide specialized products and after-sales services. Smaller and medium-sized manufacturers must innovate and differentiate themselves to stay competitive and adapt to changing market trends.

3.3 Differentiated Market Strategies

Due to the wide variety of office furniture styles and materials, patent protection is difficult. Large international and domestic furniture exhibitions have become platforms for showcasing new designs, but these innovations are often copied by smaller competitors.

This has led to concerns about product homogenization, where many office furniture brands offer similar designs, materials, and price points, making it difficult for customers to choose. In response, differentiation in design and management is becoming a key strategy for the future of the industry.

3.4 Green Office Furniture Becomes More Mainstream

Since 2017, Chinese office furniture manufacturers have faced stricter environmental regulations for production and exports. Many companies have been forced to invest in new technologies and sustainable practices, but not all factories have been able to comply.

In the European and American markets, environmental sustainability is a key factor influencing purchase decisions. Buyers prefer office furniture brands that prioritize eco-friendly materials and green production methods. However, domestic standards in China are less stringent than those in Western countries, making sustainable production a critical area for future development.

3.5 Changes in Office Furniture Style

Consumer preferences for office furniture styles have changed significantly over the years. Traditional Chinese office furniture, often made from mahogany wood, was once considered a valuable long-term investment.

Today, modern and eclectic styles are in demand. European and American design trends, including Nordic minimalism, solid wood, metal, glass, and contemporary designs, have gained popularity in China. Consumers are now looking for stylish, functional, and space-saving furniture that fits into fast-paced urban lifestyles.

3.6 Modern Marketing Methods for Office Furniture

Office furniture marketing has evolved significantly, moving from traditional retail stores to experience-based showrooms and brand promotions.

- Furniture brands have expanded from small local stores to large-scale furniture malls and franchise chains.

- Experience spaces allow customers to interact with office furniture models before purchasing, improving brand engagement.

- Online and digital marketing strategies are being integrated to enhance customer experience and drive direct sales.

3.7 The Importance of Personalized Service

The furniture industry in China is undergoing industrial optimization, shifting towards customized office furniture. With modern technology and flexible production processes, furniture can now be designed based on individual customer needs.

Key features of customized office furniture include:

- Better space utilization

- Higher durability and material quality

- Eco-friendly production methods

Chinese furniture manufacturers are investing in their own software solutions, reducing dependence on overseas systems. The shift from mass production to personalized design is reshaping supply chains, with greater emphasis on pre-production customization and customer engagement.

3.8 Shift from Price Competition to Brand Value

Traditionally, competition in the office furniture industry was based on price wars and quality battles. However, consumer behavior is shifting towards brand loyalty and trust.

The industry is moving from a price-driven market to a brand-driven market, creating new opportunities for premium office furniture companies.

Customers are willing to pay higher prices for brands they recognize and trust.

Instead of choosing the cheapest option, buyers prefer high-quality, durable products with strong branding.

3.9 Future Growth Potential of China’s Office Furniture Market

The Chinese office furniture market has strong growth potential, supported by new office developments, smart furniture innovations, and an increasing focus on sustainability.

- The expansion of office buildings and business hubs is driving demand for modern office furniture.

- More manufacturers are entering Central and Southeast China, expanding beyond traditional industrial zones.

- Despite factory closures in 2017 due to environmental regulations, companies that embrace innovation and compliance will continue to thrive.

The Chinese office furniture industry is entering a new phase, where technology, customization, and branding are shaping its future. Manufacturers that adapt to these changes will lead the market in the coming years.

4. Conclusion: Selecting the Best Chinese Office Furniture Manufacturer

In the process of purchasing office furniture in China, it’s important to understand the background of China’s office furniture industry, the distribution patterns, industry trends, and growth potential in order to select the best Chinese office furniture manufacturer.